6 Halloween Activities For Kids That Teach Money Lessons

Looking for an engaging way to teach your kids about money? Halloween offers a fun, hands-on opportunity to introduce important decision-making skills that can shape their financial future and their overall wellbeing. By incorporating money lessons into Halloween activities, you can help your children understand key concepts like delayed gratification, teaching them to make smarter choices that will benefit not only their bank accounts but also their overall health in the long run.

Why not use the excitement of the season to kickstart their financial education? Starting early with financial lessons can pave the way for lifelong habits of saving, spending wisely, and even investing. Studies show that kids who learn about money early are better equipped to make informed financial later in life - lessons that are sure to last much longer than the sugar rush from their candy stash!

Table of Contents

The Problems of Too Much Halloween Candy and Instant Gratification

6 Best Halloween Activities To Teach Money and Health Lessons

What Are We Going To Do With All This Candy?

Some of my most treasured memories of my boys’ childhood years revolve around the madness of our Halloween celebrations, especially the excitement of Trick or Treating in our neighborhood. After gathering a mountain of candy, we would host an annual party that quickly transformed into a chaotic candy-trading marketplace among the children. The kids assigned market value to Reese's Peanut Cups, M & M’s, and Tootsie Rolls, eagerly swapping them like frantic stock traders.

A few migraines later when everyone went home, we were left with a giant mess and some panic of our own. “What are we going to do with all this candy?”

If we let our children keep and eat all that candy, what message would that send to them? Would we be teaching them that overindulgence and instant gratification are acceptable choices? Or could this be a teachable moment to introduce the concepts of balance and self-control to their decision-making process?

Since Halloween can provide so many teachable moments for children in both health and financial life skills, The National Financial Educators Council (NFEC) has launched a Halloween Cash For Candy campaign to bring awareness to the link between sugar and childhood obesity and health issues while using the season as a teachable moment to form a foundation in money management skills.

The Problems of Too Much Halloween Candy and Instant Gratification

As a chocolate lover, too much candy doesn’t sound like a problem at first glance. However, the statistics tell a different story. About one-third of children are either overweight or obese, and two-thirds don't get enough daily exercise.

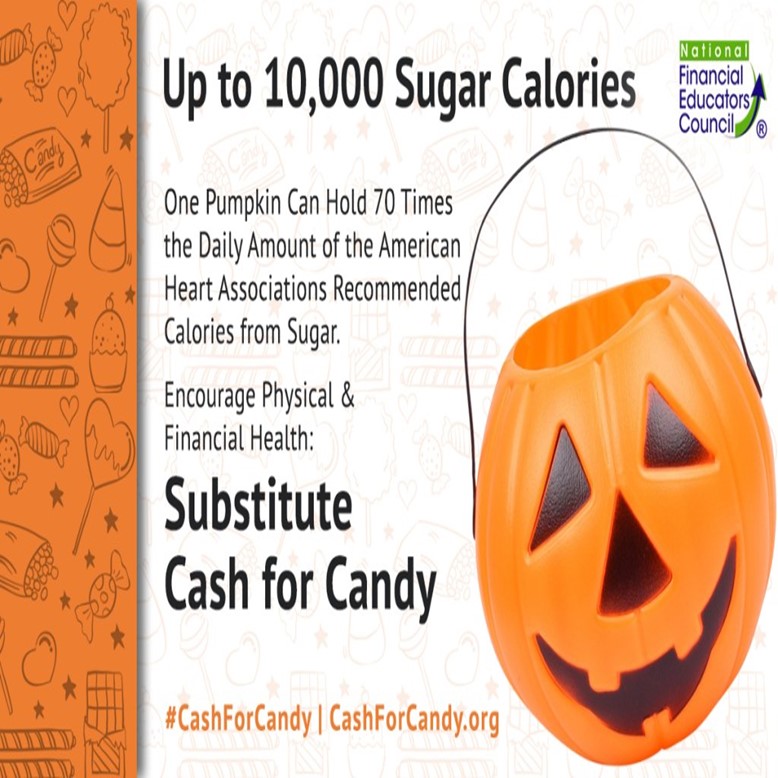

One trick-or-treat plastic pumpkin can hold up to 10,000 sugar calories or 70 times the Daily Recommended Amount of American Heart Association’s recommended calories from sugar.

Children tend to act on impulses and with that much candy on hand, the temptation is great to overindulge. While it may seem harmless since Halloween only comes around once a year, developing a habit of instant gratification at a young age can lead to serious health and financial problems down the road.

Instant gratification often leads to short-term choices that aren't in our best long-term interests. Whether choosing the empty calorie treat instead of a piece of fruit, going out with friends instead of working on a paper or studying for a test, buying something on credit instead of saving up money for the purchase, or spending all of a paycheck instead of saving some money for the future, these decisions have lasting consequences.

Even the most disciplined person gives in to instant gratification now and then, and that is perfectly fine. But when instant gratification becomes a habit, it can create problems, especially when it comes to health and finances. Teaching children to recognize and manage these impulses early on can help them avoid the pitfalls of overindulgence, both now and in the future.

The Problem of Too Little Savings

Consistently making instant gratification decisions that sacrifice long-term benefits also leads to devastating financial results. Here are just a few sobering statistics.

Almost 50% of Americans cannot pay an unexpected $400 expense.

70% of Americans live paycheck to paycheck, regardless of income.

The average student loan debt is $37,172.00.

The collective debt of all Americans is over $4 trillion.

About 33% have no money saved for retirement at all.

A systemic lack of financial education in schools is at the root of the financial literacy crisis. People are left to learn from their own mistakes and sometimes these mistakes can be very costly, in immediate costs and costs over the long term.

Children form habits by ages 7-9. Without financial education from schools or from their parents, they are left to the influence of advertisers and their peers to form money attitudes and habits.

Solution – Cash for Candy Activities

It's widely recognized that children often lack both financial education and healthy habits - two essential life skills. To address this, the NFEC is turning Halloween into a teachable moment with its annual Cash For Candy campaign, offering a fun way to bridge the gap between these two critical areas.

Games and promotions like Cash For Candy can start the process of parents talking to their kids about money. These early conversations are helpful to prepare children for their future financial realities.

The Cash For Candy campaign is designed to be fun, while at the same time promoting financial and physical health. The NFEC has come up with three options for adults to implement this innovative campaign:

Parents can do a buyback of their child(ren)’s candy where they give an agreed amount of cash for each piece of Halloween they receive.

Treat-givers can engage trick-or-treaters at their door with a fun game to give the option to receive cash instead of candy.

Organizations can participate in their own candy buyback programs. This works well for dentist offices or organizations that send candy to troops.

You will find more details on the NFEC activities and in addition to these activities, I’ve added a few to help you help your children become healthy and money-wise. Pick activities that are age-appropriate for your child.

6 Best Halloween Activities To Teach Money and Health Lessons

Activity 1: Health Lesson

Together with your child, pick five different types of Halloween candy.

Make a chart or spreadsheet with columns for nutritional, calorie, and ingredient information.

Research each type of candy and enter the nutritional, calorie, and ingredient information in the chart or spreadsheet.

Compare each candy.

Research the health issues excessive sugar may cause over the long term and the effect on a child’s dental health.

Activity 2: Make Smart Halloween Spending Decisions

Involve your child in Halloween spending planning.

Determine the items you will need to buy, such as costumes, decorations, party food, cash, or candy amount to hand out to trick-or-treaters.

Make a budget for the amount you are willing to spend for each item.

Create a spreadsheet to enter your budget and actual costs.

Research sale items and ways you can cut back on costs.

Enter your purchases on your budget spreadsheet.

Review your progress and see how you can make adjustments to stay on budget.

Activity 3: Let Them Decide – Cash or Candy

You can decide to give only a small cash or coin envelope if you’d like, but if you live in a tough city like I do (NYC), you might want to give them a choice.

You can vary the amount in the envelopes from one quarter up to a “jackpot” envelope containing a five-dollar bill.

Keep track of the number of trick-or-treaters who choose each option.

Activity 4: Cash or Candy Game

Turn the Cash or Candy into a game you play with the trick-or-treaters.

The link to the NFEC resources for the Cash for Candy campaign is provided below at the end of this post.

Access the guide for Trick-or-Treat givers.

In Option 4, Game on pages 9-14 of the guide, read the instructions, and print out the pages with the cards with each amount of currency you will have on hand to give out.

Cut the cards and put them in a container so the children can’t see them.

Allow the children to pull a card from the container. They will receive the corresponding dollar amount in cash or coin.

You can also ask them the trivia question on the card and if they answer correctly, give them an extra drawing.

Activity 5: Candy Buyback

Now that your child has researched the unhealthy choice of their favorite candy, you just might have their buy-in for a candy buyback.

As a parent, you might want to do the buyback yourself.

Agree on a set amount of cash for each piece of candy. There is an activity sheet in the Cash for Candy Family & Friends Participation Guide that you can download from the link provided below at the end of this post

If you don’t want all that candy in your house at all, you can look for organizations or dentist offices that may be participating in a candy buyback.

Activity 6: Savings Lessons – What to do with the money from candy buybacks

The money your child received from any candy buyback, whether from you or an organization, can be an excellent starting point for a conversation on spending wisely and starting a savings account.

The total amount of money received could be divided into three portions; one for spending now, one for saving for a later purchase, and one for charity giving.

Emphasize the benefits of delayed gratification to encourage your child to stick with their savings plan.

Set realistic savings goals with your child to give them a boost in achieving success.

Be sure to decide on a reward you and your child can enjoy together after they achieve their goals as an incentive.

Hopefully, your child will catch the savings bug and will start looking for more ways to save and earn.

More Details From The NFEC Website

You can find complete guides to the NFEC’s Cash for Candy campaign on their website at the link below.

https://financialeducatorscouncil.org/cash-for-candy/

Conclusion

Halloween can be a tricky balance between fun and health, especially with all the sugary candy. But it also presents a great opportunity for teaching valuable lessons about both health and money. By incorporating some of the activities and ideas mentioned here, you can turn this spooky season into a meaningful, educational experience—without sacrificing any of the fun. With a little awareness and creativity, you'll be setting your child up for a future of physical and financial well-being. Explore more activities on the NFEC website, and make this Halloween one to remember!

Smart Money Changes Everything is strictly a financial education website. The information presented in this post is solely for your general financial education and is not to be considered financial advice. Always check with your trusted financial professional team who will consider your unique situation and goals to develop your own personalized comprehensive financial plan.