TRANSFORM LIVES. ADVANCE YOUR MISSION.

TEEN FINANCIAL LITERACY EMPOWERMENT STARTS

AT YOUR LIBRARY

Inspiring, Motivating, and Transforming Financial Education

Created Especially for Teen Library Programs

Request Your Free Resource:

A Librarian's Toolkit: Turning The Page To Teen Financial Empowerment

WATCH VIDEO NOW

Together, We Can Launch Teens Into Lifelong Financial Security

Teens will face significant financial choices sooner than they realize - often without the proper education or resources to guide them.

Your library is uniquely positioned to bridge that gap. As a librarian, you have a powerful role in guiding young people toward lifelong learning.

By partnering with Smart Money Changes Everything, your library becomes a launchpad where teens build financial confidence and prepare for the real world ahead.

OUR PROGRAMS

Bring Lifelong Learning Beyond the Bookshelves

Here are some recent teen library programs we presented throughout Nassau and Suffolk counties:

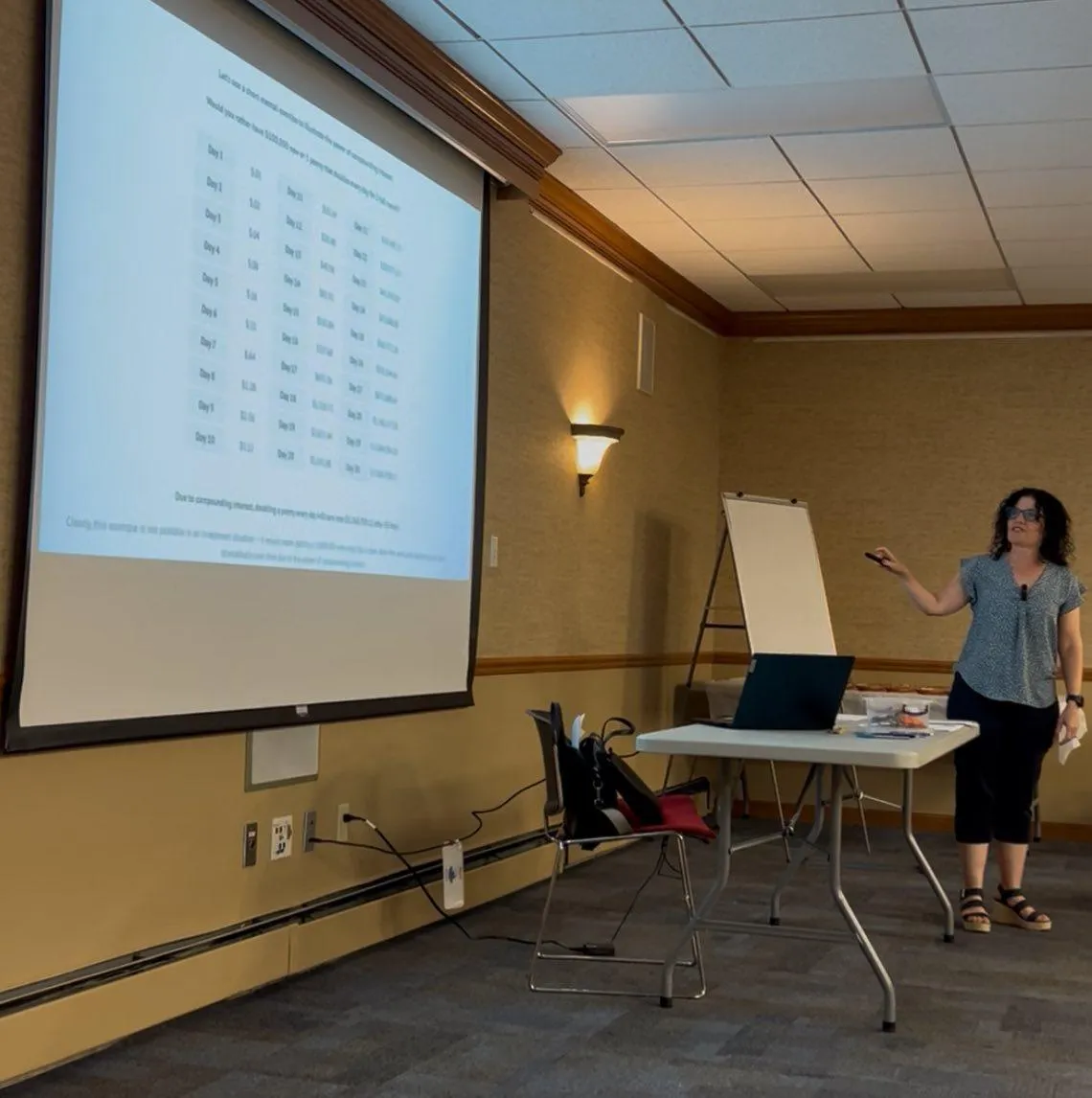

Becoming An Accidental Millionaire Through the Power of Compounding Interest

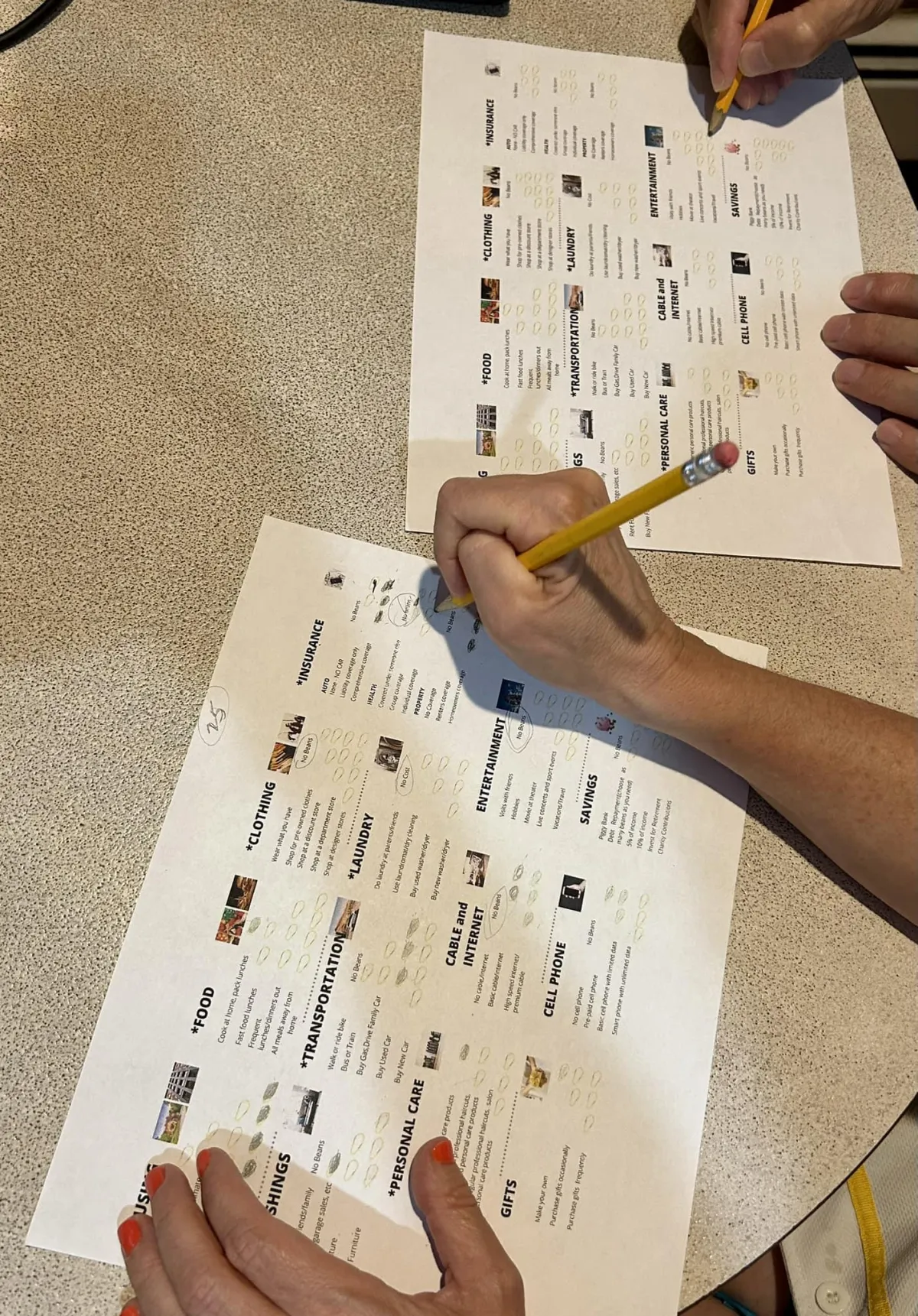

Money and Values: Introduction to Budgeting

Money Decision-Making For Teens

Big Savings Decisions

Big Spending Decisions

Real World Money Skills for Teens

Car Buying Workshop

College Planning Workshop

FEEDBACK in their own words

What our teen students told us they learned from our programs....

"Budgeting is more important than I thought"

"I never knew compound interest applied to credit cards as well"

"Although compound interest is very slow at first, it has great rewards"

"Save a percentage of every paycheck"

"I should start saving at an early age"

"What the main priorities for budgeting are, such as food, shelter, clothes, and insurance"

"Needs, savings, and then wants"

"I was surprised by how much interest the credit card charges"

"Unexpected things can happen, so you should have an emergency fund"

"It's very hard to choose wants vs needs"

"I learned how to map out a plan for budgeting"

"Significant budget cuts must be made to accomodate for real-life circumstances"

"Budgeting is really needed, especially if you don't make enough money"

"Budgeting is harder than you think"

"Start saving and investing early - instead of impulsive spending"

"Invest your money as early as possible"

"I should be aware of how much I spend with my part-time job as I never care to see how much I pay"

"One thing I learned today was just how difficult it is to cover all the expenses in life "

"Planning ahead of time saves you from debt"

"Planning for big purchases, such as car buying, makes the process much easier"

"I learned to let my money work for me, and that we don't need a lot of things"

"Most people don't have the knowledge of planning ahead and have to face the results of their decisions"

"To plan a lot of things ahead of time instead of waiting to the last minute to make important decisions"

"I learned about the 20/4/10 car loan rule"

"Will help me make better decisions and build an emergency savings plan"

"Evaluate and assess a decision instead of having your mind set on one thing. There is more out there to research before deciding"

"I learned how helpful it is to budget and save"

"I learned about the Rule of 72"

"I enjoyed the program; it was interesting and fun. It will help me when I get older and help with my goals for my future"

"I enjoyed it. The instructor was very interactive and informational"

"It was very informational and motivational"

"I learned how hard it is to balance everything. I thought it was easy to pay for everything, but I never thought of emergencies happening"

"I didn't expect to take away so many resources for car buying and college planning from a library workshop. Thank you so much."

straight from our teen student survey

Topics our teen students want to learn in future sessions....

Paying for College

529 Plans

Credit and Credit Scores

How Savings Affects Financial Aid

Budgeting

Savings- how to open accounts

Investing for the Future

Stock Market

How to Start a Business

Side Hustles

Entrepreneurship

Account Management

MEET the founder of

smart money changes everything

Donna Cirillo, MBA

Advisory Board Member of the New York Financial Educators Council

Accredited Personal Finance Instructor

Certified Financial Education Instructor

Certified Financial Literacy Professional

REQUEST YOUR FREE RESOURCE TODAY

A Librarian's Toolkit:

Turning the Page to Teen Financial Empowerment

connect with me today

Let's Brainstorm to Bring Financial Literacy to Your Library

Everyone agrees teens should receive a financial education. Since schools generally don't include personal finance in their curriculum, you can fill the gap by bringing engaging financial literacy solutions to your library. Schedule a call today or connect with me on LinkedIn.